36+ maximum deduction mortgage interest

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Web Most homeowners can deduct all of their mortgage interest.

Paying Off A Mortgage Early How To Do It And Pros Cons

Web If the result is more than 100000 you can only claim a deduction of up to 25000.

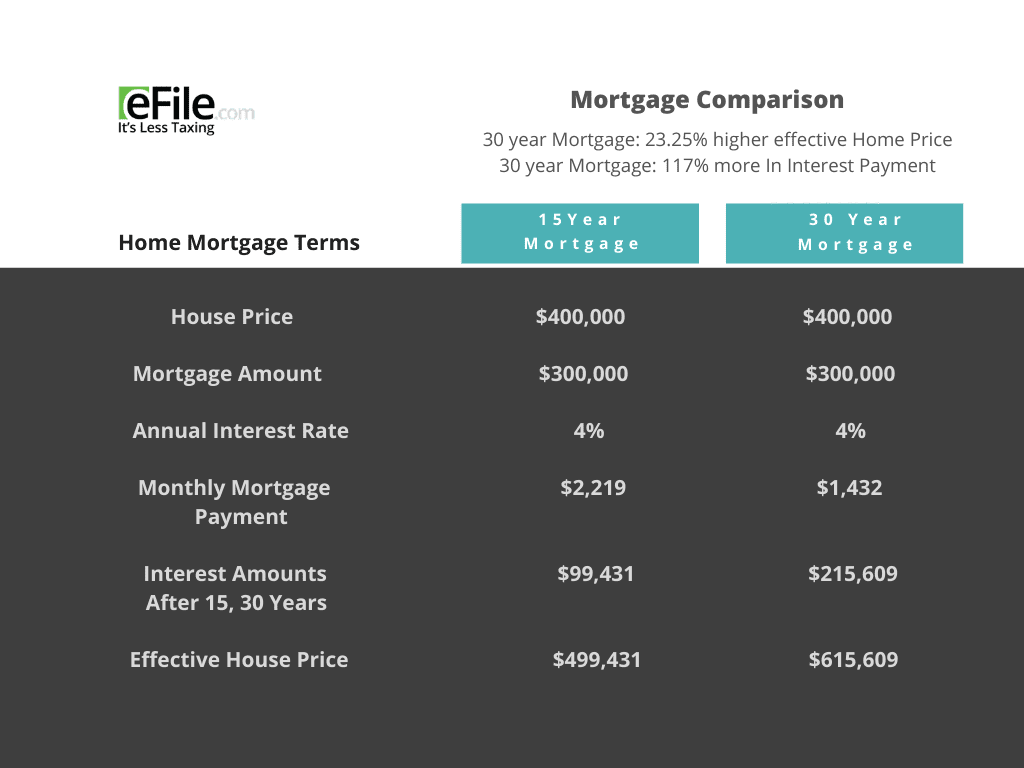

. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Comparisons Trusted by 55000000. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Compare Lenders And Find Out Which One Suits You Best. Web A SHORT HISTORY.

Ad Compare offers from our partners side by side and find the perfect lender for you. Web How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction. Owning property was less.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Homeowners who bought houses before. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Looking For Conventional Home Loan.

Web Is mortgage interest tax deductible. Web Web Mortgage interest deduction limits If you took out your mortgage on or before Oct. THE MORTGAGE INTEREST DEDUCTION The mortgage interest deduction was instituted federally in 1913.

Web This deduction provides that up to 100 percent of the interest you pay on your mortgage is deductible from your gross income along with the other deductions for which you are. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Mortgage Interest Deduction On. Ad 5 Best Home Loan Lenders Compared Reviewed. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web 1 day agoMortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

That cap includes your existing. There are also some special rules that apply if you live in a high-tax state. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Mortgage Interest Deduction On Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service.

Deduction On Repayment Of House Loan Under Section 80c Simple Tax India

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Ravi Saladi Beng Iit Mba Iim Supply Consultant Self Employed Linkedin

Maximum Mortgage Tax Deduction Benefit Depends On Income

The Effect Of Mortgage Interest Deduction And Mortgage Characteristics On House Prices Sciencedirect

Haiboxing Remote Control Car 2 4ghz 1 18 Proportional 4wd 36 Km H Hobby Rc Car Offroad Monster Rc Truck Waterproof Rc Truggy Rtr Off Road Toy Amazon De Toys

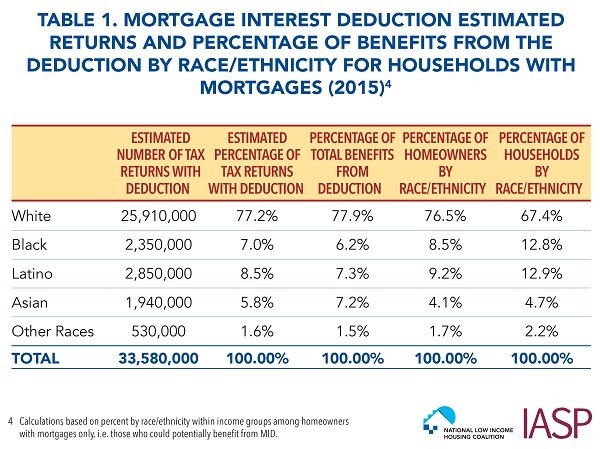

Race And Housing Series Mortgage Interest Deduction

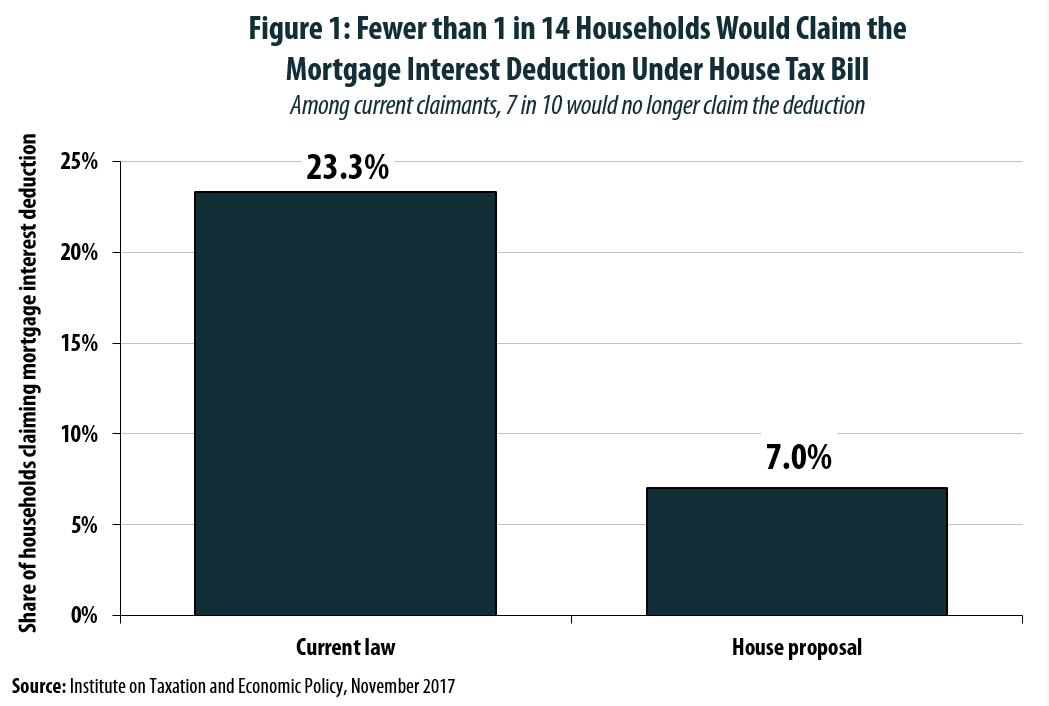

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

Mortgage Interest Deduction Bankrate

Paying Off A Mortgage Early How To Do It And Pros Cons

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

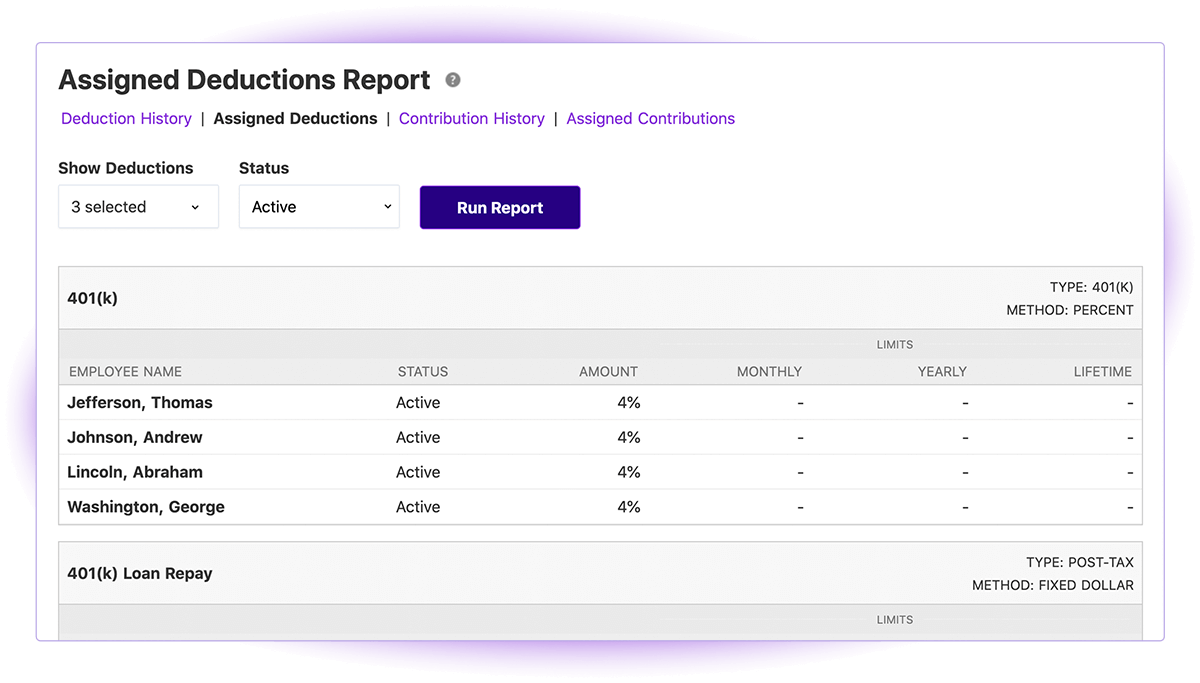

Payroll Software For Small Business Patriot Software

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Rules Limits For 2023